Personal Tax- How to show Transitional Profits 2024 examples/queries/reports

Article ID

personal-tax-how-to-show-transitional-profits-2024-examples

Article Name

Personal Tax- How to show Transitional Profits 2024 examples/queries/reports

Created Date

17th April 2024

Product

IRIS Personal Tax

Problem

IRIS Personal Tax- How to show Transitional profits 2024 onwards examples, queries, reports with Trade comp, Tax comp and SA100, Box 68 SEF4 'Adjustment to arrive at profit/loss for this period'

Resolution

UPDATE JULY/AUGUST 2024: We have been advised by HMRC on how to cater for this scenario (on extended/shortened periods) and have released the IRIS version 24.1.9.2 and also 24.2.0 to cater for this, please update to this version here.

For the FULL KB on the Basis Period Reforms and Transitional profits 2023/2024 onwards

Due to the HMRC changes the design of the TRADE COMP, SCHEDULES OF DATA, TAX COMP and the SA100 Self employment and Partnership Pages are updated.

1. Always run the Trade computation first as it will show the separate profits that will be taxed for the ‘standard profit/loss’ and the ‘transition profit’. The report then will total all values up to the give the profit/loss for the basis period (eg If Transitional Profits are calculated, the combined total of the Period + Transition period total £XXXX is meant to show only in the Trade comp and not on the Tax comp/SA100).

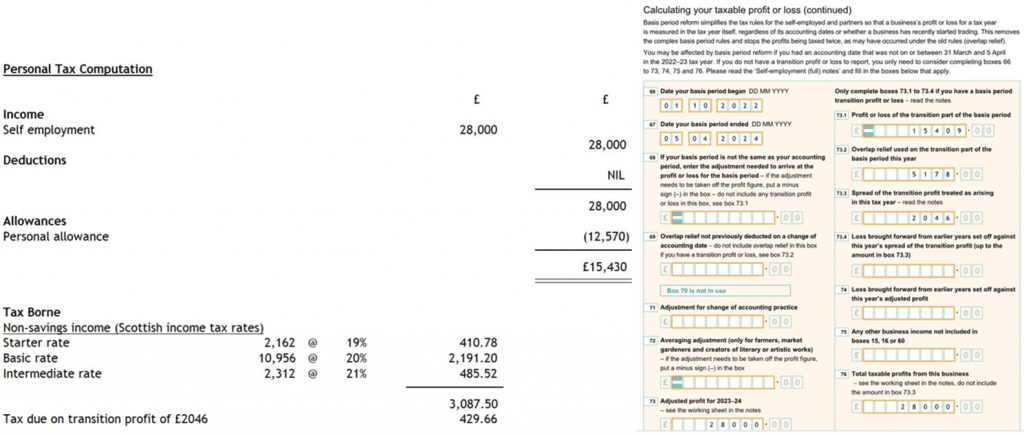

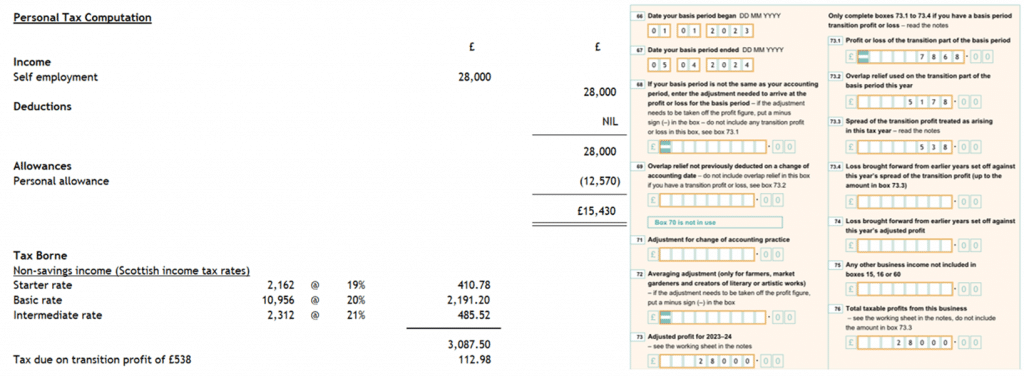

2. Tax comp and SA100. If Transitional Profits are calculated – the profit/loss for the Standard basis period figure and Transition Part very bottom ‘TOTAL’ is not supposed to show on the Tax return or the Tax computation, the figures will be shown separately. Only the standard part profit should show under Self-employment /Partnership part in the income section. The transition profit is brought into charge separately in the liability section – this is how the tax calculation is set out by HMRC.

3. Tax Comp Tax due on the transitional profit. The Tax comp will only show the transitional profit value as being taxed if its possible (Row shown as ‘Tax Due on Transition Profit of £XXXX’ and if income is below the personal allowance then no transitional profits/tax will be calculated on the Tax comp. There is no breakdown of this Tax due calculation apart from the Trade Comp which only shows the amount which is to be taxed). NOTE: The tax due is not set at 20% so read this KB

4. Schedules of data – The calculated total values of income are not meant to be reflected on the Tax comp/SA100 (Exactly like the Trade comp).

NOTE: There are two trade computation layouts: One when transitional profits/taxed are being applied (then it will apply the very top ‘Standard’ profit value into the Tax Comp (steps 1 to 3) and the 2nd design if the Transitional Profits are not taxed and will instead use the very bottom ‘Profit/Loss for basis period’ TOTAL to be used on the Tax comp.

If a Sole trade SA100– The standard profit/loss will show in Box 64 SEF3 and the transitional profit treated arising will show in box 73.3 SEF4 . The standard profit will show in the income section of the tax computation as income and the transitional profit treated as arising will show under the borne section.

Sole Trade SA100 Box 68 SEF4 and Adjustment value appears- why? PT is correct on SA100 and Schedules of Data. In most cases it comes from two+ self employment pages or one trade. The first set of pages are called the ‘extra pages’ and it will have the information for the first accounting period, however the ‘calculate your profit or loss’ section will not be populated. Therefore the profit/loss for this accounting period, will show as an adjustment in box 68 on the 2nd set of self employment pages, which are the main pages. The 2nd set of pages will have the information for the 2nd accounting period(transitional period) up to box 64/65. However boxes 73.1 – 73.4 will also be populated with this information. So 73.1 will have the profit/loss of the transition part. As this value is also in 64, that means the profit is being double counted. So we also need to add the negative of box 73.1 to box 68. So box 68 will be made up of the profit from the 1st accounting period and the negative of the value in 73.1 from the 2nd accounting period. On the Schedules of Data, the Box 68 value will show under ‘Adjustment to arrive at profit/loss for this period’ and is the difference between the 1st period Net business profit compared to the 2nd period Net business profit.

Transitional Profits are missing from the Tax comp and thus not taxed- The Transitional Profits are showing on the Trade comp but the line ‘Tax Due on Transition Profit of £XXXX’ is missing on the Tax comp. This is by design if the income is below the personal allowance then no transitional profits/tax will be calculated on the Tax comp (and only show on the Trade comp).

If a Partnership SA100- The standard profit/loss will show as in Box 16 and the transition profit treated arising will show in box 16.3. (If no transitional profits then 16.3 will be empty)

Currently PT provides Transitional Profits on the examples below for a Sole Trader and similar for Partnerships

1. Transitional Periods/Profits options only appear in the 2024 Tax year. If you change year (at the top of PT) to 2023 or 2022, then the function/box for it will not appear.

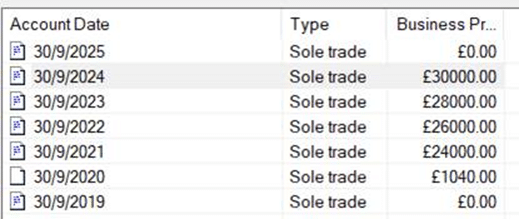

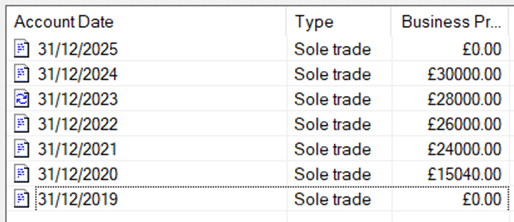

2. Check all your period entries: Below is a example period for 30/09/2024 etc and that the previous periods are also identical 30/09/2023, 30/09/2022 etc. There is another example at the very bottom for 31/12/2024 period.

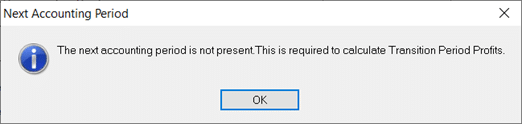

Note: If you are working on a 2024 tax year you MUST also create a 2025 accounting period or the Transitional data may not show.

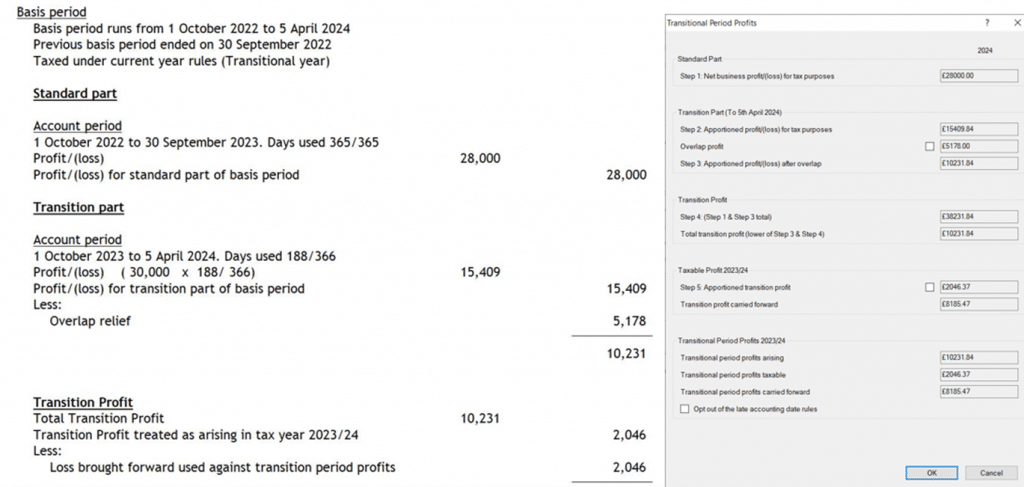

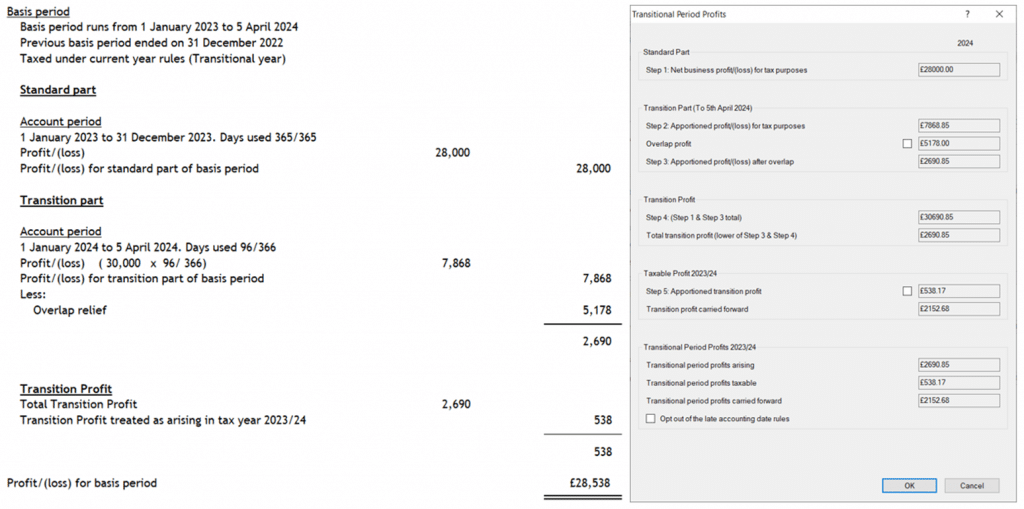

2. Run a Trade Computation. It will run the standard 1/10/2022 to 30/09/2023 – £28K. THEN it will run Transit period from 01/10/2023 to 05/04/2024 based on the days – 30k x 188/366 = £15409(less overlap)= £10231. This creates the ‘Transit Profit’ which shows on the Self employment Summary screen. This £10231 is divided by 5(years) and give a final apportioned profit of £2046 which is applied in the Tax comp (showing as taxed).

If income is below the personal allowance then no transitional profits will be calculated.

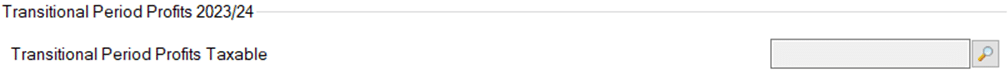

3. Open the relevant period, go to the bottom and select the magnifying glass for ‘Transitional Period Profits 2023/2024’ and ‘Profits Taxable’, this opens the summary screen. You can override the Step 5. apportioned profits by ticking and entering a higher amount (NOTE: you cannot give less then the apportioned value or it will not save).

Trade comp is left image. Summary screen is right image

4. Run a Tax computation. If there are profits, then it will show £2046 as taxable = £429. This ONLY appears as a new line on the Tax comp below the % tax calculations total called Tax due on transition profit of £XXXX. See left image

5. Run a Tax return. The values will show on updated SA100 Self employment OR Partnership Tax pages. See right image on SEF4 Page (Full Self Employment 1page) and Box 67 is auto filled with the correct 05/04/2024 end period. Note the Taxed value will not show in its own box (as no box exists) and only appears on the Tax comp.

I have the correct periods but still no transitional profits show?

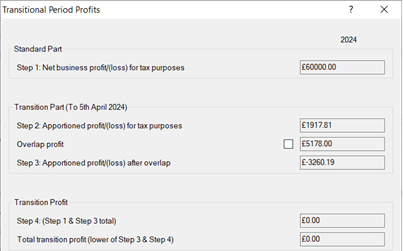

a. Check your income level entries over 2 periods. If the income is insufficient then a loss(negative) will show on Step 3 and no transitional profits will be given. For example in the image below: In the Trade comp, under the Transitional period section: if the profit amount is insufficient and the ‘Overlap Relief’ exceeds the profit then a loss is created (As on step 3 below) and no transitional profits will be given. As a test you can edit the income (and also of the other period) and run the Trade comp to see the difference on the calculations.

b. Check all the other dates (not period dates) for the client in that trade eg Dates for ‘cessation of trade’ and you have correct dates under “Involvement – like From and To” etc

c. Check if you have the next period added in with the relevant income (eg if you have periods 31/12/XXXX, then make sure you also have a 31/12/2024 with income entry as well). You may get a warning if the next period is not entered in to explain why no profits are given:

If a period is saved as 31/12/2024 as another example, so you can see the same type of calculations etc.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.