Personal Tax: Retrieve Sole Trader Covid SEISS data from HMRC

Article ID

personal-tax-retrieve-sole-trader-covid-seiss-data-from-hmrc

Article Name

Personal Tax: Retrieve Sole Trader Covid SEISS data from HMRC

Created Date

27th August 2021

Product

Problem

IRIS Personal Tax- How to retrieve Sole Trader SEISS data from HMRC?

Resolution

In 2021 it is now possible to retrieve the amount of SEISS grants claimed by an individual for a specific tax year for Sole Traders, as well as whether an individual falls within ‘off payroll working’.

The software will automatically update an individual’s corresponding employment record where they are classed as falling within ‘off payroll working’. The SEISS grant will appear as an entry on the exception report.

- You must be on IRIS version 21.2.0 or later (Help and About)

- You must have your HMRC data retrieval setup: https://www.iris.co.uk/support/knowledgebase/kb/personal-tax-hmrc-data-retrieval-error-not-working-no-data/

- Load the client and select relevant year

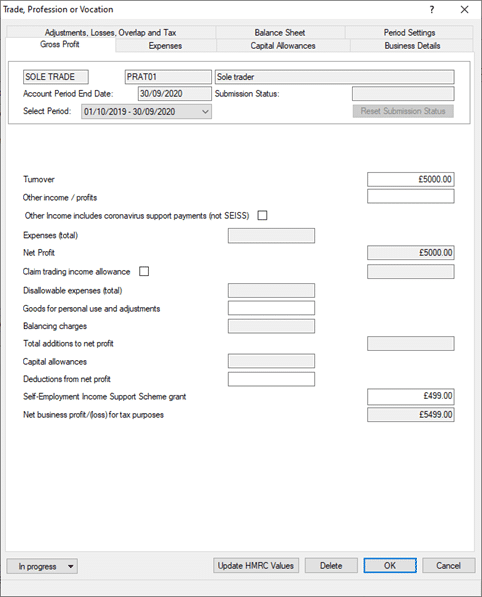

- TPV, STP

- Open the relevant sole trade accounting period

- Gross profit tab –at the bottom click ‘Update HMRC Values’

- NOTE: Due to this new feature there can be starter issues from the HMRC server where wrong data or a error or no data shows up. They have asked users to try later or manually find the data.

- The agreement with HMRC is only for Sole trader SEISS data and not yet Partnership SEISS.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.