Personal Tax- Use Sole/Partnership Trade loss against current income?

Article ID

personal-tax-use-trade-loss-against-current-income

Article Name

Personal Tax- Use Sole/Partnership Trade loss against current income?

Created Date

20th September 2021

Product

Problem

IRIS Personal Tax- How to use/offset Sole Trade or Partnership loss against current income?

Resolution

1.Load the client and select correct year

2. on the left side go to TPV, STP and select the correct period

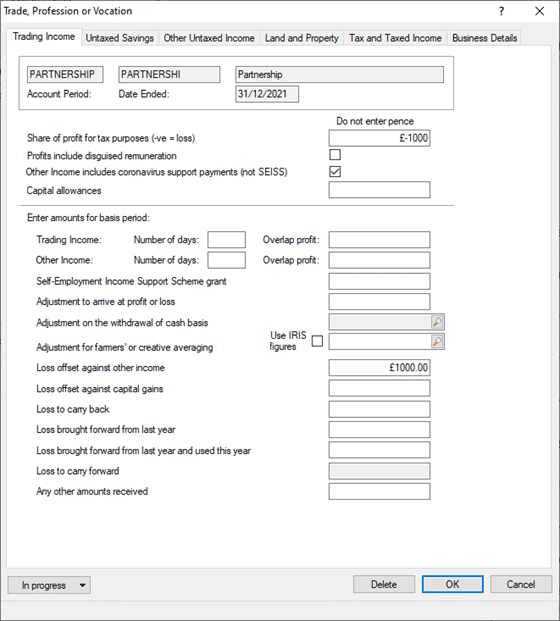

3. IF a Partnership – on the ‘Trading income’ tab – enter loss value in the box ‘Loss Offset against XXX’

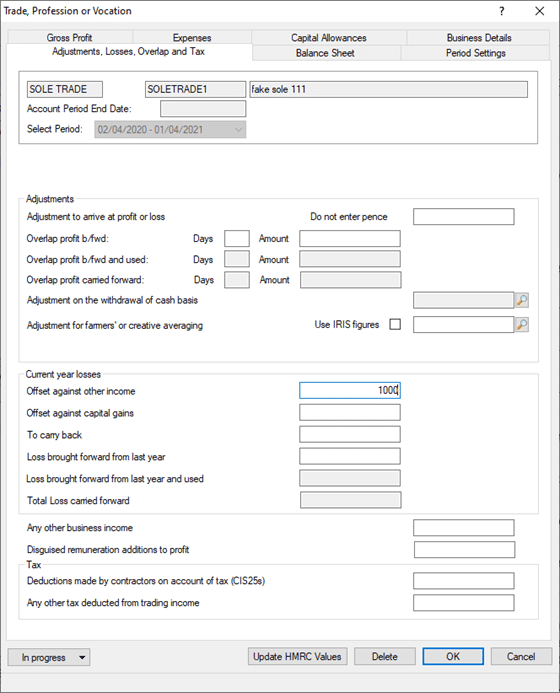

4. IF a Sole trader – on the ‘Adjustments, Losses’ tab – enter loss value in the box ‘Loss Offset against XXX’

5. OK to save and close

6. We recommend you also run the ‘Trade computation’ (under reports) which refreshes the client and then check the Tax comp.

NOTE: If you have created TWO separate trades in PT (with the same name). This counts as ‘two’ entities which you cannot share the losses between the two (as per the HMRC rule). There’s no tool in PT to merge 2 trades together. If you believe these two are the same entity (eg its actually one sole trade business) – then you need to decide which trade to keep (eg usually the one which has run the longest time and has the loss) and remove the one which is newer (put a ceased date in the past for it so it wont show up). Then add in the missing relevant income/expenses to the one trade you have kept.

If you have a loss brought forward to use against other income: https://www.iris.co.uk/support/knowledgebase/kb/personal-tax-brought-forward-trade-loss-not-being-used-against-other-income/

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.