VAT Filer- Standalone queries and GP VAT standalone

Article ID

vat-filer-standalone-queries

Article Name

VAT Filer- Standalone queries and GP VAT standalone

Created Date

6th April 2022

Product

IRIS VAT Filer

Problem

VAT Filer Standalone queries and if you are using the GP VAT filer standalone

Resolution

There are two VAT types: the ‘VAT Standalone’ and ‘GP VAT standalone’

IRIS VAT Filer will automatically connect and retrieve any previous MTD submissions and current obligations for the selected client direct from HMRC. This also retrieves any liability and payment data directly from HMRC for the client and displays this information on screen.

The ‘periods’ shown on the left side are from HMRC (and not from IRIS). If the periods are incorrect, for example, incorrect quarterly or month, then you would need to contact HMRC and ask they correct them.

Ensure your on the latest VAT Standalone version: Help | About.

VAT standalone version: You can check to update here: https://www.iris.co.uk/support/iris-accountancy-suite-support/iris-standalone-vat-filer/ OR https://www.iris.co.uk/support/iris-accountancy-suite-support/as-downloads/ (at the bottom). The VAT standalone guide on how to use the VAT filer is also part of the weblink above.

Also make sure your VAT license has been activated (go to Settings and the Licenses Tab, check you have the activated license here) or you cannot submit any VAT submissions.

The GP VAT Standalone

Check your version as you need to be on latest version- https://www.iris.co.uk/support/product-support/gp-accounts-support-downloads/ . You will need to contact the GP accounts team on usage of the GP VAT Filer on: 0344 815 5555 or email on GPAccountsSupport@iris.co.uk

How to reset agent credentials

If you do not have a option at the top called Setup and Authorised Agents then you are on another version of VAT Filer like the Standalone version. You may have the Setting option instead in which case, click the link to reset your agent credentials: https://www.iris.co.uk/support/knowledgebase/kb/kba-03808/

- If you have any issues then email Support@iris.co.uk with your version and screenshots of the error. Ensure the title of the email is VAT standalone.

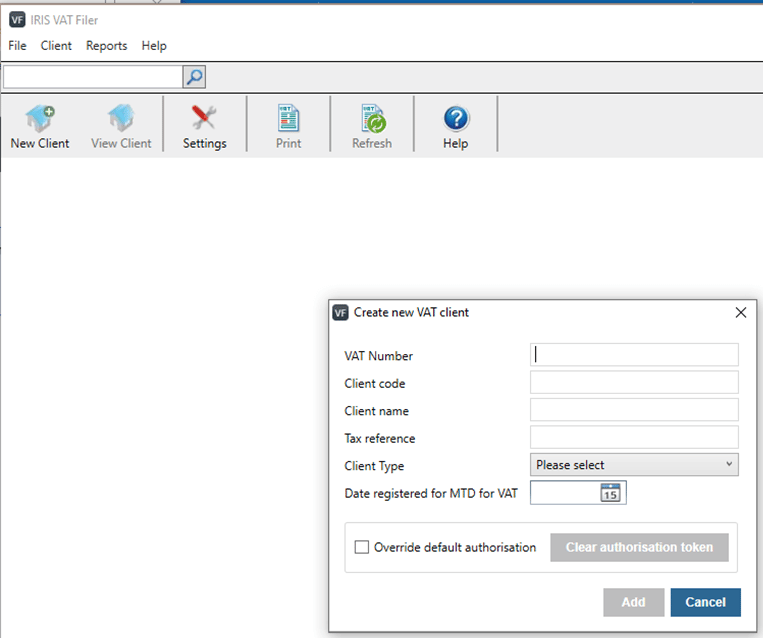

You need to create your VAT clients– fill in this with clients details. The CLIENT CODE: is a unique ID code you have to manually give a client. Every Client must have a unique ID.

To import Excel and CSV files into the VAT standalone

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.