PTP Autumn 2021 Full Features v21.3

Overview

Our PTP Suite Autumn release version 21.3.201 includes all legislative updates to ensure your ongoing compliance as well as some new features and enhancements, including the latest Accounts and CT Taxonomies, customer influenced enhancements to accounts and IRIS OpenSpace is added to the default printer options.

PTP Accounts Production (v21.3.583)

FRC 2021 Taxonomy

We have applied the latest Taxonomies issued by the FRC and HMRC for 2021. This will give qualifying accounts formats access to the most current iXBRL tagging to support electronic filing requirements for both Companies House and HMRC.

Shareholders’/members’ deficit

Following a request by a group of customers in the Ideas Portal, we have included the option to refer to the Shareholders’ funds as Shareholders’ deficit. This can be toggled in the Data Screens from the Balance Sheet/Options folder, selecting the first data screen FRS 102 (or FRS101) – Options and scrolling down to the bottom of the screen. If there is a comparative year or period present the narrative will be defined based on corresponding prior year or period Data Screen.

The tick in the Data Screen will not carry forward year on year to avoid accidentally referencing the total as a deficit when it may not necessarily be the case.

The same change is also available for LLP Accounts in the event of a Members’ deficit.

Statement of Income and Retained Earnings

Similarly, following another request by another group of customers in the Ideas Portal, the Statement of Income and Retained Earnings will now automatically carry forward year on year once ticked for the first time, saving time and ensure the disclosure remains consistent year on year.

Updated data Screen Autopilot

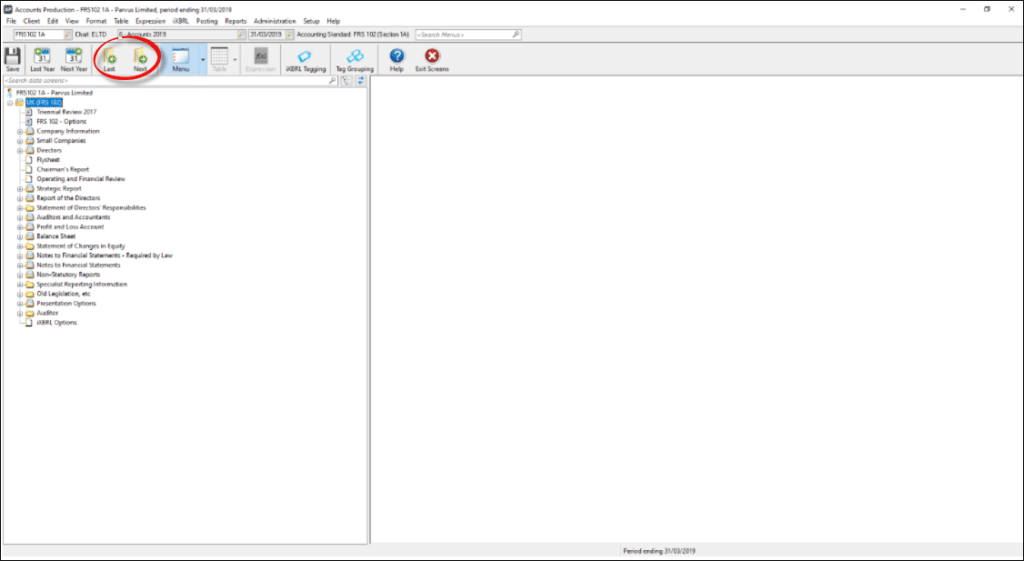

We have updated the Autopilot routine for Data Screens. The Autopilot can be accessed from within the Data Screens by clicking on the Last and Next buttons as shown in the screen shot below.

By clicking on Next, this will take you forward through the mostly commonly used data screens filtering out those that are less commonly needed and if you make a change to that individual screen by clicking on Next it will automatically save the changes and move onto the subsequent screen in the Autopilot sequence automatically.

This solution saves time particular for first year or period sets of accounts or when using the Data Screens for the first time.

Option to Disable Capital Account in Partnership Accounts

Historically when preparing Partnership Accounts even though postings had not have been made to Capital Account codes 975 to 978, the Balance Sheet would still show a Capital Account by default.

For this release we have included an option within the data screens, to refer to the Capital Account as the Current Account. To enable this function, from within the Presentation Options Data Screen folder select Balance Sheet Data Screen and tick the override box at the bottom of the screen.

Fixed Asset Investments increased Additional Items

From within the Related Undertakings data screen folder, we have increased the number permissible for each of the following, Subsidiaries (from 15 to 30), Joint Venture (from 3 to 10), Associated Companies (from 3 to 10). For Subsidiaries Not in Parent this has been increased (from 8 to 15). This is to help with more complex sets of accounts.

Additional Directors / Members Changes Since Year End

Within the Company Information report for Limited Companies, it has always been possible to show Directors’ that have been appointed and resigned since the period or year end.

For this release we have doubled the number permissible for each scenario from 5 to 10. To access this disclosure from the Data Screens, go to the Directors folder and select “Directors’ Changes since Year End”. A similar improvement has also been made for Members’ of LLP’s.

Updated Default Accounting Standard for new sets of Accounts

When preparing accounts for the first time in Accounts Production where applicable the software has historically set the default accounting standard to the FRSSE.

For this release we have altered this to be set to FRS102 section 1a by default for the appropriate entity types. The other accounting standards are still available from the same drop-down list, but overall, this will save you time in this area.

PTP CT Platform

Latest CT Taxonomy

This release includes the latest CT Taxonomy which includes the changes around capital allowances for the Super Deduction and Special Rate Allowance.

Updates to the CT600L

The CT600L has been updated in accordance with the latest guidance from HMRC, specifically the treatment of any brought forward expenditure credit and where it is applied in the RDEC calculation steps.

General

IRIS OpenSpace – default print option

The option to upload documents to IRIS OpenSpace is now included as a default print option. Previously, if IRIS OpenSpace credentials were saved in the PTP Tax Platform and/or CT Platform then IRIS OpenSpace would automatically be selected as the print output option even if the default was set to Printer or Preview.

IRIS OpenSpace has now been added to the Default Print Output To selection under the Printing tab located in Tax Offices and Firm Details Maintenance so that there is now full control over the default print output.