IRIS Winter Full Features 23.4.0

Overview

Continuing with our commitment and supporting the latest legislation the IRIS Accountancy Suite Winter release version 23.4.0 provides critical updates to support the first wave of changes brought about by the recent Economic Crime and Corporate Transparency Act and updates to the way accounts are tagged for electronically filing.

IRIS Company Secretarial

Economic Crime and Corporate Transparency Act 2023

The Economic Crime and Corporate Transparency Bill passed into law on 26th October 2023. This reform will have significant effect on the way Companies House operates and will ultimately leading to reforms in the public register. From the 4th March 2024 or also known as ‘Day 1’ there will be several changes to certain forms and we have updated the software to match for both electronic submission and corresponding paper forms.

- AD01 & LL AD01 (Change of registered office address) – a new section 3 now appears on the form to confirm that the address is an Appropriate registered office address. Within the software a tick box has been introduced to confirm, this is included when creating the event.

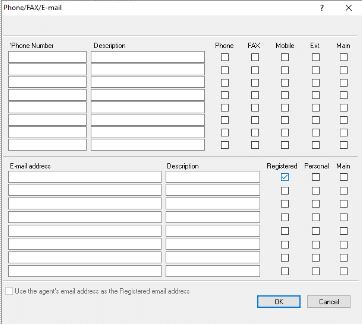

- CS01 & LL CS01 (Confirmation Statement) – effective from 5th March. All initial CS01 or LL CS01 must include a valid registered e-mail address. This e-mail address will be used by Companies House for all future communication. This can be an agents e-mail address and we have included an option for this. The e-mail address can be entered in the screen below. The second change in the CS01 or LL CS01 includes a Lawful purpose statement; this can be selected when you create the confirmation statement event.

Should you have any existing forms that have a date or a made-up date prior to 4th March (or for Confirmation statements 5th March), then where practically possible we recommend you file these so that they will be accepted in their existing form. Beyond that date, Companies House will be enforcing new filing schemas and forms, the schemas that predate 4th and 5th March will then be rejected by Companies House. The software will adopt all the new electronic schemas and forms from the dates above onwards.

(AA02) Dormant Company Accounts – iXBRL Taxonomy Update

From 1st April 2024 Companies House will be implementing some changes which alter the validation where a revised or amended dimension is used in the (AA02) dormant accounts. As part of this release, we have included a change to the way the accounts are tagged to allow electronic filing to continue.

IRIS Company Formations

Economic Crime and Corporate Transparency Act 2023

(IN01) Application to register a company and (LL IN01) Register a limited liability partnership.

As with Confirmation Statements (above). From the 4th March all IN01 and LL IN01 submissions must include a valid registered e-mail address. For the IN01 only, it must also include a lawful purpose declaration. For consistency the data entry in the software will be same as Company Secretarial. The software has also been updated to recognise the appropriate electronic filing schemas paper forms. Whilst any old-style forms electronically submitted after the cut-off date will be rejected by Companies House but again could be paper filed.

IRIS Accounts Production

iXBRL Taxonomy update

From 1st April 2024 Companies House will be implementing some changes which alter the validation where a revised or amended dimension is used in the accounts. As part of this release, we have included a changed to the way the accounts are tagged to allow electronic filing to continue unhindered.