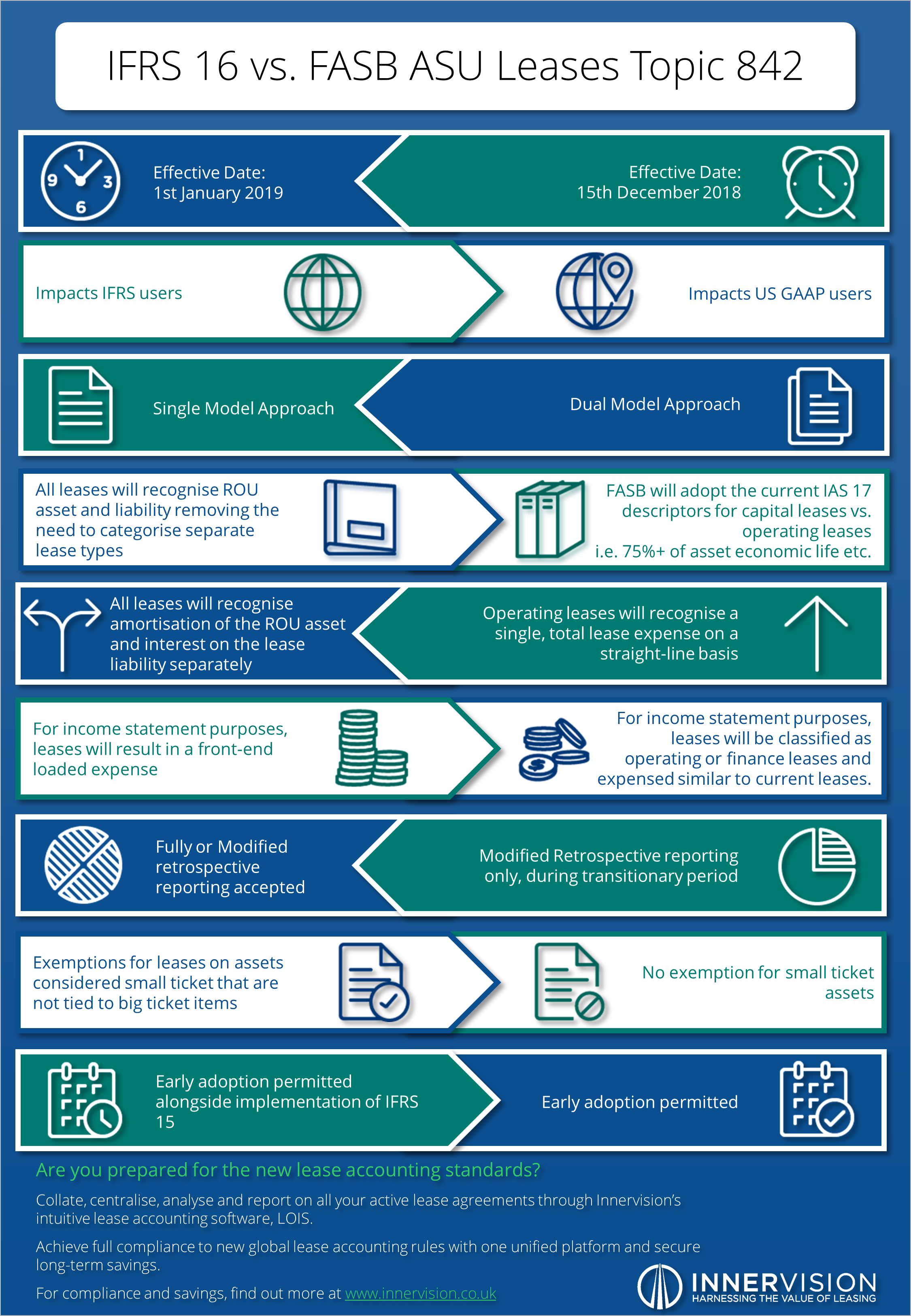

IFRS 16 vs. FASB ASU Leases Topic 842: The Differences (Infographic)

Updated 26th May 2021 | 3 min read Published 24th March 2016

Earlier this year, the Internatinal Accounting Standards Board (IASB) and the Financial Accounting Standard Board (FASB) published their respective new lease accounting standards.

IFRS 16 and FASB ASU Leases Topic 842 are set to revolutionise the way leases are accounted for as operating leases can no longer be treated as "off balance sheet". This will provide greater clarity and comparability of an entity's true financial position, lease liability and outstanding assets.

An estimated $2.8 trillion dollars of lease commitments will come onto the balance sheets of the 1 in 2 global listed companies that will be impacted by the transition to these new standards.

Download our concise overview of the new lease accounting standards, IFRS 16 to learn how to prepare for the financial impacts of compliance

From day one, the IASB and the FASB aimed to produce one final converged standard that would be consistent globally. However, despite the fact that both boards believe they have solved the core problem - i.e. that 85% of lease agreements and commitments do not appear on balance sheet - there are some clear differences between the two standards.

Our leasing experts have put together this useful infographic highlighting the main differences between the FASB and IASB standards. As entities will only apply one of the new standards, they are unlikely to notice the difference from an internal accounting viewpoint. However, with the project still remaining joint and numerous updates and announcements about both standards appearing alongside one another, it is important that lessees have a clear understanding of what their standard entails and how it differs from it's respective opposite.

The publication of IFRS 16 and FASB ASU Leases Topic 842 represent the biggest change to lease accounting in at least 30 years. The biggest warning from accounting professionals is the concern that many businesses have not yet adequately identified or planned for the impact that these standards will have not just on their finacial statements, but also their leasing practices too.

Members of globally leading audit and accounting firms such as PwC, Deloitte and Grant Thornton have all shared their concerns that businesses must not underestimate the amount of work the preparation and processes will require. Most notable is the need for a complete and accurate account of an entity's total lease portfolio; a requirement many businesses are lacking.

"Many companies have disparate systems for tracking, monitoring, and housing lease agreements."

Sheri Wyatt, PwC

In order to ensure full compliance and ease the burdens and costs associated with the tranistion to the new global leasing standards, many businesses have implemented lease accounting and lease management software.

Systems such as LOIS, allow companies to centralise, analyse and report on all of their active leases, managing the entire transition process from one unified platform. LOIS has been designed with functionality specifically developed to ease the transition to new lease accounting and can produce reports for current, new and comparative lease accounting standards.

With an established and organised system for hosting lease agreements in place, businesses can not only ensure full compliance to lease accounting standards, they can also guarantee greater visibility and control of their portfolio as well as on-going savings and optimisation in their lease management.

If you are concerned about your lease management and are interested in optimising your companies leasing to achieve savings and full compliance, be sure to get in touch with Innervision’s leasing experts about our comprehensive solution to lease accounting, LOIS.