Do you have to auto enrol your carer?

Updated 11th July 2022 | 4 min read Published 12th March 2015

The simplicity is wrongly presumed, however. While this seems highly questionable, when you take away the context of the situation to leave yourself with the bare bones; at the most simplistic level that carer is a worker and you as their employer (if they meet certain criteria) must comply with the government's workplace pension reform.

As you can imagine, this is a harrowing thought for many in already vulnerable positions. Are you worried about whether you have carers, assistants or even contractors that you are unsure about?

Many have reported horror stories of which people are receiving threatening letters from The Pensions Regulator (TPR) in a "comply or die" fashion explaining that they will be met with harsh fines if they do not auto enrol their carer into a workplace pension scheme.

TPR have taken this on board and have now released a set of guidance notes in order to help those through auto enrolment and to better prepare them for what is in store. One of the very first parts of the guide explains:

"If your care is provided by an agency, and it pays your personal assistant’s national insurance contributions, the agency is the employer and you don’t need to do anything."

Confusion has been rife with this legislation change and TPR have identified that clearing up eligibility for those with a carer is extremely important. The next part explains that only people that you employ directly (Whether you use direct payment from your local authority, the NHS or if you fund your own care/support) need to be auto enrolled and even then, they need to meet certain eligibility criteria based on their age and earnings.

One of the main reasons that TPR found for people not complying with auto enrolment was simply the non-submission of the Declaration of Compliance. A lot of people are under the impression that you simply need to undertake your auto enrolment duties and then be done with it. This is not the case.

The Declaration of Compliance is your opportunity to show off to the regulator that you have indeed complied with the new legislation and this is also the case for those who employ a carer.

If after you have assessed your employee(s) you find that in fact, you don't need to auto enrol anyone at all, the Declaration of Compliance still needs to be completed. There is guidance on how to do this on The Pension Regulator's website.

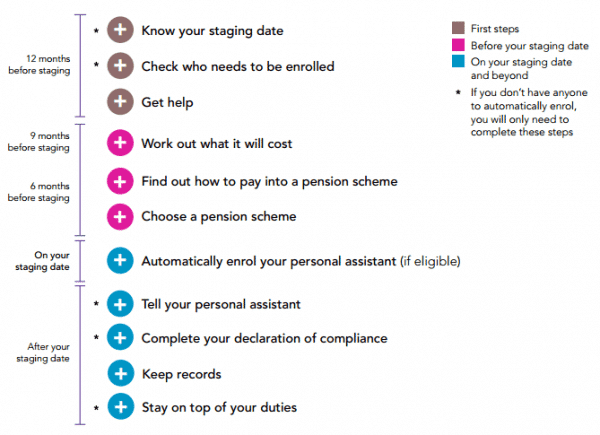

Below is a plan that TPR have put together to help those with a carer through auto enrolment and what to do at each step along the way.

As you can see, the first part is to find out when your staging date is. This is important as it allows those with a carer to easily align the TPR's auto enrolment plan (above) and then work out what they need to do by certain times.

The guide also goes on to explain what makes employees eligible (if they are over the age of 22; under the state pension age; and are paid over £192 per week or £833 per month then they are eligible) It then links to the TPR's Know Your Workforce page.

TPR also understand that this amount of information and legislation compliance may be a little too much for those already in need of help and care and will allow the person receiving the care to nominate a contact to receive the pension communications updates on their behalf, thus reducing the burden. This could be the same person who usually deals with other tax and payroll duties.

Auto enrolment is something that will affect us all over the next few years and this unfortunately means that those in need of a carer have to comply also. The rest of the guide from TPR helps to guide people through the process in simple, understandable terms. You can find the full guide here.

IRIS have developed an auto enrolment solution; the IRIS AE Suite™ that can not only take care of the assessment criteria on an ongoing basis, but also distribute payslips and P60s electronically to the employee and communicate their pensions communications. This takes place within the payroll run, making a seamless, simple process.

To find out more about the IRIS AE Suite™, you can book a demo completely free.