VAT Filer - Internal Server Error or Date periods vanish or Agent/Client not authorised or VAT registration number not valid

Article ID

vat-filer-internal-server-error-or-date-periods-vanish-or-agent-client-not-authorised

Article Name

VAT Filer - Internal Server Error or Date periods vanish or Agent/Client not authorised or VAT registration number not valid

Created Date

13th July 2021

Product

IRIS VAT Filer

Problem

IRIS VAT Filer and you get a error: Internal Server Error or on the left side no Date obligations appear or on the bottom right you get a Agent/Client is not Authorised message: then follow these steps:

Resolution

Please check if just 1 client (or a select number) or all clients are affected

IF it affects just one or certain clients (other clients are fine): It can be how you setup this one client (especially if a new client), if you have used correct VAT registration, HMRC MTD set up or random HMRC issues, so follow all the steps below. This can also happen randomly for one client which worked fine before and can be related to MTD registration issues from the HMRC ASA side.

IF it affects ALL your clients: Its more likely with a issue with your ASA login and how you set up clients on the VAT (like using alternatives/branches). Also if there is a recent HMRC technical/outage issue then no vat periods will show for any client.

Prior to using the IRIS VAT filer you must have: created an ‘ASA’ (Agent Services Account), mapped your existing client relationships over to this new account. Then registered your clients to MTD and then got a confirmation email from HMRC. We will assume this has been done correctly. If not then contact HMRC to set this all up or read here: https://www.iris.co.uk/support/knowledgebase/kb/vat-authorise-the-software-to-interact-with-hmrc/

The VAT Filer needs a stable internet connection as it has to collect the VAT client data from the HMRC server.

a. You must be on the latest IRIS version. Go to Help | About and Check for Downloads. The latest version will pick up any changes to the HMRC side so do ensure this is done first. You may also need to reset your ASA login on step g).

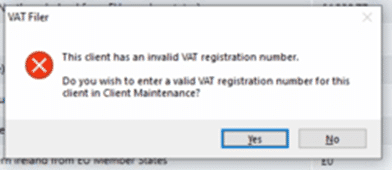

b. Load the Client, go to Client | View | Tax tab. The clients VAT code is correct (letters are not allowed, for example you try and use ‘GB’). Spaces in the code can cause this error to show – so remove the spaces and save.

c. Go to Date range on the left side of the VAT filer and edit the dates from the period you can see to six months in the future OR go further back in time if a older period is missing – then click Client refresh. Check if you get the same warning.

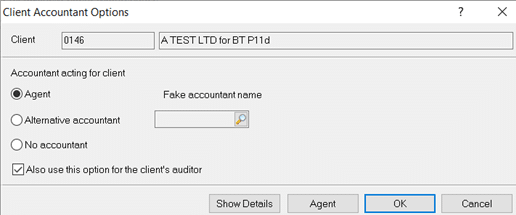

d. Go to Client, then View and then Accountant and check if its set to Agent OR Alternative OR Branch. Exit the screen. If its set to Alternative or Branch then you need to check with your team if that’s correct and if yes then which ALT or branch you should be selecting. If you have several branches/alternatives then please be careful as it affects your usage of the VAT filer – read the KB article at the bottom

e. Go to Setup, Authorised agents – your name (initials) or your company name should appear with the VAT filer credentials (IF set to ‘Practice’, if each users has their own login to submit VATs then it will be set to ‘Individual’) – BUT if you see several identical names with the VAT then you have branches/Alternatives setup- read the KB at the bottom:

What if we change from ‘Individual’ to ‘Practice’ or vice versa? DO NOT SWITCH until you read this: as changing the option will automatically reset all currently saved logins and delete them (For example if its set to individual and you have 10+ users listed, and you change to ‘practice’, it will delete all individual 10+ logins and they cannot be recovered. You will need to switch back to ‘Individual’ and ask every affected user which was deleted to manually login again with their HMRC login (by clicking retrieve data). If several clients need a specific ASA login to submit returns then read the Setup of Alternative and Branches (not using Agent) lower in this KB.

I do not have a ‘Setup’ option at the top – this KB article is not relevant for you (This is for ‘IRIS Accountancy’ users) because IRIS has several VAT programs with their own support teams- go to Help and About and check which VAT filer you are using and contact that support team.

What is the Authorised date – the date next to VAT filer is when it was last registered. If this date is between 12 to 18+ months old then there is a chance it will be automatically be unauthorised by HMRC and you cannot submit VATs. You will need to reset and log back in (step ‘e’).

f. If your name doesn’t exist – exit the screen and click ‘Client Refresh’ at the very top. Go to step h).

g. You need to reset your ASA credentials. If your name appears (against the VAT filer row) and you have the ASA login details – then click your name (always double check you have the right name) and tick Reset agent credentials and say yes to the warning. Your name will disappear, exit the screen. Click Client Refresh at the very top.

h. You will be ask to login to the HMRC site with your ASA login (it is very important you use the correct ASA login or you will be unable to submit anything). This HMRC login screen will try and use your Windows Edge/Explorer browser to appear and operate. Click Grant authority.

i. If the same warning appears or no obligation dates appear then recheck your ASA login and ensure its correct. If you’re unsure then repeat step b) onwards again and try another login.

j. You may need to wait up to 24 to 48hrs as HMRC data can sometimes take time to be processed and allow periods to show/no errors. Note an often issue reported is that the error /missing data still occurs AFTER waiting 24/48hrs, so just reset it one more time, as users have reported it working after running it again. See the summary of steps:

- Reset your ASA login and check – if same issue then wait 24/48 hrs

- After 24/48hrs but the same issue then again reset your ASA login one more time, some users have reported this 2nd reset works.

- If it continues to fail, you will need to call HMRC support (see notes below).

k. If all your clients are still affected by this error/issue then its very likely your IRIS version OR your ASA login OR your Agent credential login OR your setup of Branch/Alternative OR a HMRC issue is the cause. Read the steps above again because if one of these fail then the VAT filer will not work with any client. If you try again and all fail then you must contact HMRC support.

Calling HMRC Support if one or more clients still do not work, ask for a HMRC senior to speak to:

Ask them to check your ASA login and that you have registered your clients to MTD correctly. If you want to check – log into your ASA account on the HMRC website and look at your clients registration for MTD. If they are correct then you have this option:

If HMRC supports give you a code/reference number to pass back to IRIS VAT support, do state back to them: that the IRIS VAT filer only presents the periods/data from the HMRC system and we do not edit in anyway the HMRC data shown to the users, so this code/ref cannot be applied within the IRIS VAT filer and thus cannot be used by IRIS to fix the issue. Note: If HMRC support asks to ‘reinstate the periods’ – they mean for you to edit/extend the date range fields on step C.

Advise after 2022 onwards: If all the steps on this KB do not work then HMRC have also advised users to log into their HMRC agent site and there is a feature to ‘Manage my permissions HMRC and reset the agent’ which has resolved the VAT issue (you will need to ask HMRC support on this). You would log into your HMRC page, it provides a list of authorised software. You will find and click on the IRIS option and use the remove authority option. Log out of the HMRC site and load the IRIS VAT and reset your ASA login and relog in again, wait a moment and now check the clients.

Advise before 2022: Do not ask for this after 2022 as they have ceased this advise. Help reset/refresh/reconnect your clients registration for MTD or delete the clients registration for MTD and set it back up again which is known to fix this issue. (There is a random issue where your clients registration to MTD gets disconnected). This can only be done via your ASA login or from HMRC. Also if they can show you how to reset this using your own ASA login, then you will not need to contact HMRC every time this happens.

Setup of Alternative and Branches (not using Agent)

This usually needs to be setup because you organization has several different offices or agents all over the UK etc. Each has their ASA login and don’t use one login for all submissions. Read this KB: https://www.iris.co.uk/support/knowledgebase/kb/iris-pt-bt-vat-how-to-set-up-alternative-and-branches-to-submit-returns/

Open ‘Authorised Agents’- identical names showing?

This is because you have multiple Alternatives or Branches setup with the same identical name – so you cannot tell which one is linked to which Alt/Branch. Read this KB which is also relevant for the VAT filer (change ‘pre-population’ to ‘VAT filer’). https://www.iris.co.uk/support/knowledgebase/kb/personal-tax-hmrc-data-retrieval-authorised-agent-identical-names-showing/

Reset my agent credentials and clicked ‘Client refresh’ but HMRC login doesn’t appear

Do you have multiple Branches or Alternatives or multiple logins for the VAT? if yes – this usually means your Agent credentials is still active and you deleted another credential from another office/vat user. Look at step d). You need to check you have selected the correct Branch or Alternative. or person. Once you have corrected this then click ‘Client refresh’ and the HMRC login will appear. Also we recommend you contact all your branches/ alternative offices/or fellow VAT users to tell them their credentials may be deleted and they need to test and register back in again.

If you have checked everything – no alternatives, no other vat logins, no other pcs etc, then check your IRIS version (Help and About) and update it to latest version and restart IRIS. If that dosnt work then HMRC will always try and default use your pcs ‘Internet Browser/EDGE’ to run these HMRC pop ups, you will need to update the browser first.

One Period shows Green tick and Complete but it was never submitted

1.Try the Agent Services Account (ASA) reset one more time and make sure your on latest IRIS version

2. Do wait 24-48 hrs – as it can take some time for HMRC to update their records

3. If the same thing happens – load another client – then go back to original client

4. It could have been sent to HMRC, so do check if they received it and ask for the IR/batch ref code if they did

5. If all the steps above fail then do contact HMRC and speak to a senior.

For a specific client – getting ‘Internal Server Error’ appear several times and no periods show? We have had feedback from users/HMRC where they have had random technical issues affecting random clients (which was then solved by HMRC, as it involved your ASA code on their side being incorrect). First reset your ASA again and log back in and wait 24/48hrs. If no periods show and the same pop up appears and you need to close it multiple times- then contact HMRC and speak to a senior to investigate this specific client.

Claim a refund and need to enter a MINUS value? HMRC rules – you cannot enter minus values into the VAT to get a refund (it may show as a positive value on screen when imported), you will need to contact HMRC on this refund.

Imported Values into the wrong period – how to remove/correct? You cannot delete imported values. Either import again with the correct values OR import values of 0(zero) in all the cells, this will show up as 0s in all cells. You now need to remember to keep track of this period before you submit.

How to submit amended VAT? HMRC doesn’t yet permit amended VATs to be sent online. You would need to contact HMRC support directly to request this.

How to attach additional information on how the VAT values were calculated? HMRC only require the submission of the values of the 9 boxes, nothing else. You will need to contact HMRC support on how best to send them additional details (also if you need to mention the vat scheme accrual or cash basis etc).

Run report for VAT submission but only has 0 zero values? This is a random issue which we cannot replicate (Also affects vat submissions and liabilities screen), and we believe its a environmental issue (do try different pcs etc) and your technical team needs to look into this. The recommended workaround is to take a screenshot of the main VAT screen where it shows the values.

Run report for a submitted VAT but it crashes. If all users, clients, pcs/machines are affected then contact IRIS Support. If its just one client then try again later as other users tried this and now works. Also make sure your printer drivers are up to date. Workaround: Take a screenshot of the submitted VAT if you need to keep a record.

Submitted VAT period but shows 0 zero values? Can you click on ‘Liabilities and payments’ then click back on the period affected, the data will reappear.

A VAT period but shows identical values from another period? Can you click on ‘Liabilities and payments’ then click back on the period affected, the correct data will re-appear.

Want to show VAT periods before 2018: For example need to show period for 2009 or 2010 etc, those dates are ‘pre VAT MTD’ and therefore the IRIS VAT Filer is not appropriate and you cannot get the period to show/submit this online (even if that old period shows under the HMRC MTD). Also the original HMRC VAT Online service was discontinued from November 2022 (May 2023 for annual filers). You will need to contact HMRC as they may now expect a paper submission. The VAT MTD officially started April 2019 – which is when the first periods to which MTD VAT applied.

Periods missing after 2022: Go to Date range on the left side of the VAT filer and edit the dates from the period to a date back to 2021 etc – then click Client refresh. The missing periods will now show up. The VAT filer is defaulted to look at ONE YEAR back from the year you are on which is why they are hidden from view.

Latest VAT annual period is missing eg 2022/2023? Read this KB

Incorrect periods appear/Edit Periods? You expected a certain set of periods to show but you are getting incorrect ones instead. The IRIS VAT system doesn’t store VAT periods /nor edit any VAT periods (We have no permission to store/edit any period dates), the periods listed are coming directly from the HMRC systems. If incorrect periods appear then you will need to contact HMRC and speak to a senior (This has happened to other users as well). HMRC would already know that VAT software (such as from IRIS) only shows periods provided by HMRC. Also try and extend the date periods FROM/TO calendar and also reset your ASA login and log back in (step G see further above) as this could possibly pick up the correct periods.

Submit your own companies VAT return (not for another company): Read this KB

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.