IRIS Personal Tax

HMRC-recognised personal tax accounting software enabling your journey to Making Tax Digital (MTD) from self-assessment tax returns to P11D, and now with IRIS Elements SmartTax, delivering real-time tax calculations for tax planning.

Personal Tax accounting software delivers compliance with ease, keeping your business ahead of the curve

Every practice needs to ensure that their business is compliant, this can be time consuming and complicated. Staying ahead of legislation and complex tax rules can often leave you will little time for developing more advisory services to better help your clients.

With IRIS Personal Tax, your software is updated to ensure you have the latest Making Tax Digital functionality to cater for changes to the tax scheme, allowing you to spend more time preparing your clients and your business.

Tax planning just got easier

To help your tax planning, our IRIS Elements SmartTax feature for real-time tax calculations will allow you to create ‘what-if’ scenarios with ease, adding value to your services and your clients. You can also find SmartTax in our cloud accountancy practice software suite: IRIS Elements – featuring powerful accounting tools including tax return software and practice management software. To find out more about tax and our full range of solutions visit our tax software page.

Fully Integrated

- Reduce the need to re-key and remove the potential for error with our one stop shop Personal Tax software.

- Integration with many of IRIS’ other Accountancy services means that the data is already available and accessible.

- Integrations include: IRIS Business Tax, IRIS Trust Tax, IRIS Dividends Service, IRIS Payroll, IRIS P11D and IRIS Earnie, Kashflow, HMRC along with CSV imports for all other major 3rd party data sources.

Making Tax Digital Ready

- IRIS Personal Tax is MTD ready which means you can get ahead at your own pace.

- Moving clients from Tax Returns to MTD can be handled and easily tracked in the one product.

- Integration with IRIS OpenSpace makes communication with your clients simple and the Tax Return approval process quick and easy.

Ease and automation

-

Simple data entry form, software automatically navigates the legislative complexities and calculates the client’s liability including areas such as FTCR, Top slicing, Basis period, CGT.

- Removes the need to run multiple manual calculations or use 3rdparty tools, resulting in higher efficiency and a higher degree of accuracy in calculating the client liability.

IRIS Elements SmartTax

IRIS Elements SmartTax is a tax simulator that delivers ‘real-time’ tax calculations within IRIS Personal Tax to improve efficiencies enabling true tax planning. Cloud-based innovation available today in your IRIS Personal Tax software.

- Real-time updates to your clients’ tax calculations.

- Simple ‘what if’ scenarios run instantaneously.

-

Faster updates reflecting the latest HMRC updates to the tax calculation without the need to update the desktop

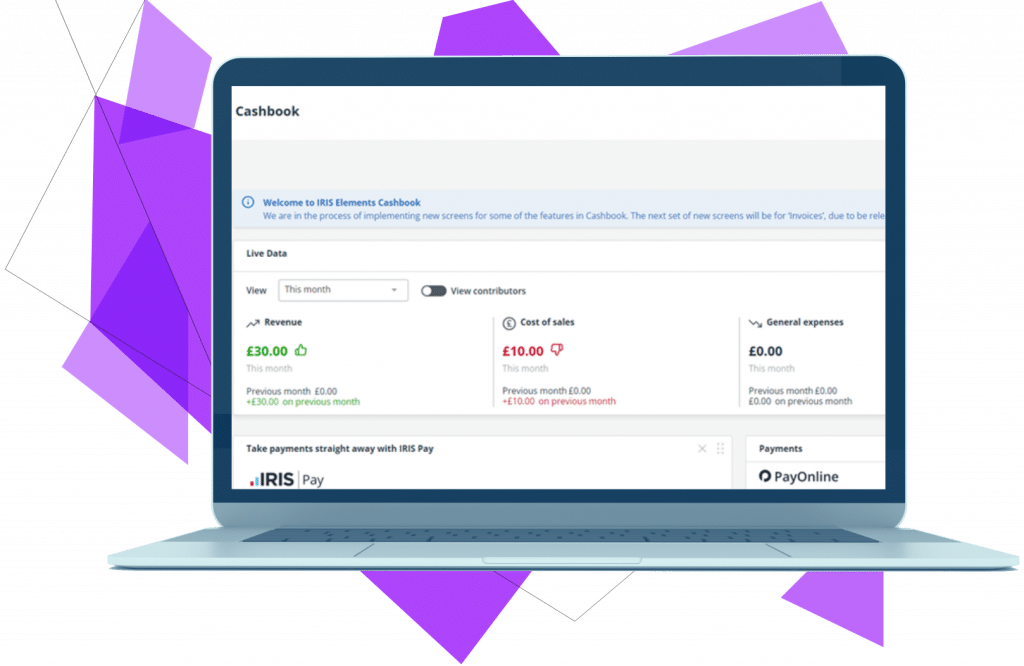

FREE bookkeeping tool

- An easy, step-by-step tool

- Free of charge with selected products

Why choose IRIS Personal Tax?

MTD Ready

Get ahead in MTD and start quarterly filing today with Personal Tax accounting software.

Fully Integrated

Reduce risk of error with our fully integrated suite of products to help you support your clients across their needs.

Compliance with ease

Over 40 years of building solutions that work for you and HMRC, making your compliance our primary concern.

Automation

Tax calculations that mean you don’t need multiple tools to get the job done.

Product Offering

- No time-consuming manual tax calculations are required as Business Tax automatically carries out all tax calculations using the data already entered.

- Effortlessly prepares the tax computations for limited companies, partnerships and sole traders.

- A 98% acceptance rate with HMRC.

- A simple approach to data entry, no pre-existing trust return knowledge is required.

- Tax return validation completed prior to submission to HMRC to reduce errors.

- Easily computes double taxation relief and retains portfolio data for assets and securities.

- Fully integrated with all IRIS Accountancy Suite, IRIS Payroll, IRIS Docs, PTP & Keytime.

- OpenSpace is a hybrid of Dropbox and DocuSign, which gives you the best of both document sharing and approval.

- IRIS Payroll for Accountants makes it easy for practitioners to use the same product to manage multiple payrolls for their clients.

- A revolutionary new dashboard improves client management, increases efficiency and saves time.

- The payroll rollback feature allows practitioners to reverse and correct an individual’s payroll.

FAQs

-

IRIS is and will continue to be fully MTD compliant, enabling your business to be ahead with MTD changes encouraging business growth.

-

IRIS allows you to submit online the full financial position of any individual regardless of the complexity or how niche the client situation is.

-

It is possible to import data from a range of professional bodies and bookkeeping software’s to reduce manual input and human error. It is possible to import data from 3rd party software from Kashflow and CSV file for Sole trade and UK land and property data to assist with MTD filing.

IRIS also assist with importing data directly from HMRC which pulls the following data:

Individual Employment information, Individual Income, Individual Benefits, Individuals Tax, Individuals marital status, Individuals NI -

We have a dedicated support section on this website and you can either email us at support@iris.co.uk or contact our IRIS support number on 0344 815 5551.

-

Assurance and compliance are the primary services of any firm, practice, business or organisation. We understand that you rely on software solutions to get it right, every time – no compromise. Speak to us and find out why IRIS are the leaders in compliant software; call 0344 844 9644.

-

Speak to us today about how you can get started with IRIS. Call 0344 844 9644 to discuss your requirements; we’ll help you get started.