AE Config Tool - Step 5 - Choose your pension provider

Article ID

12049

Article Name

AE Config Tool - Step 5 - Choose your pension provider

Created Date

6th April 2018

Product

IRIS PAYE-Master, IRIS Payroll Business, IRIS Bureau Payroll, IRIS GP Payroll, IRIS Payroll Professional, Earnie

Problem

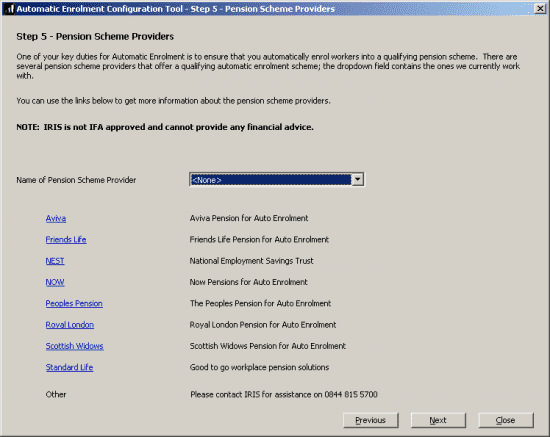

From the drop-down menu select your pension provider. This field contains the providers we currently work with.

Before setting up any automatic enrolment details we strongly recommend you make sure your payroll software is up to date with the latest version.

Please visit our downloads page to check for updates to your software

Click here

Resolution

Simply select the pension provider you use for your automatic enrolment pension.

If your pension provider is not listed here we can provide you with bespoke reports to work with their systems. Bespoke work of this nature would incur an additional cost, please contact our sales on 0344 815 5700 to discuss your requirements. In the meantime, select ‘<None>‘ for this step.

Please Note: Royal London is not included as standard in PAYE-Master.

For more details on the individual steps of the configuration tool, please follow the links below:

Step 1 – Your company’s staging date

Step 2 – Nominate a contact with The Pensions Regulator

Step 3 – Contact details of the pension administrator at your company

Step 4 – Pre-staging workforce assessment

Step 6 – Pension Provider scheme details you will use for automatic enrolment

Step 7 – Define the pay elements for Qualifying and Pensionable Earnings

Step 8 – Pension Provider output file details

Step 9 – Configure your Postponement Period

Step 10 – Declaration of Compliance (register) for The Pensions Regulator

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.