Business Tax: Partnership Trade Computation correct but the Tax Return is wrong/missing data.

Article ID

business-tax-partnership-trade-computation-correct-but-the-tax-return-is-wrong-missing-data

Article Name

Business Tax: Partnership Trade Computation correct but the Tax Return is wrong/missing data.

Created Date

11th November 2021

Problem

IRIS Business Tax: Partnership/LLP Trade Computation is correct but the Tax Return is wrong/missing data.

Resolution

- Load the client and select the relevant period

- Go to ‘Trades’ at the top of the screen

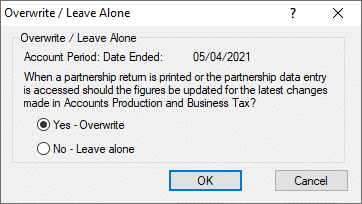

- Partnership, Overwrite/Leave – set this from NO to YES and OK

- IF it was already set to YES then switch to NO instead

- Run the trade comp to ensure its correct and then run a Draft Tax Return.

The majority of partnerships and LLPs in BT looks for data directly from Accounts Production- the YES setting says to look for the AP data.

Switching to NO – means to look for manual entries made in BT (and no longer from AP). This is usually used to made adjustments/corrections in BT without modifying AP data.

If the Tax return is still incorrect after you made this edit then check the Page PL2 box 1.38 and 1.39. Is box 1.38 totaling up correctly? if not then it will affect the calculation in box 1.39 giving a incorrect profit. Try these steps if you have any Property income:

- Trades/Partnerships/Overwrite-Leave Alone – set to ‘No Leave Alone’

- Land and Property – Furnished Holiday Lettings – Tax adjustment – press F8

- Land and Property – Other Property Income – Tax adjustment – press F8.

- Now run the Trade comp and then Draft Tax Return

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.