AE Config Tool - Step 1 - Your company's staging date

Article ID

12045

Article Name

AE Config Tool - Step 1 - Your company's staging date

Created Date

16th June 2016

Product

IRIS PAYE-Master, IRIS Payroll Business, IRIS Bureau Payroll, IRIS GP Payroll, IRIS Payroll Professional, Earnie

Problem

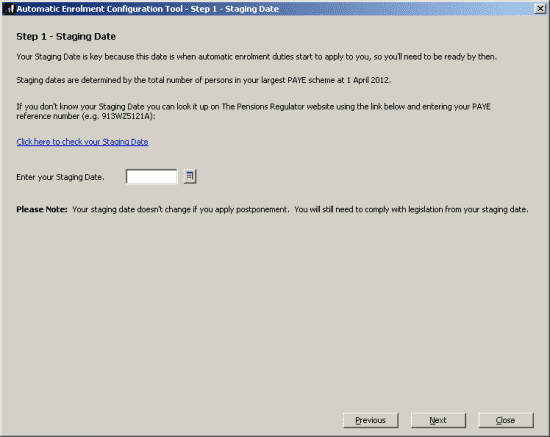

In step 1 all we have to do is type in the company staging date.

Before setting up any automatic enrolment details we strongly recommend you make sure your payroll software is up to date with the latest version.

Please visit our downloads page to check for updates to your software

Click here

Resolution

Please Note: This must be recorded as the actual company staging date, ignoring any planned postponement period.

If you are unaware of your staging date you can check, using the company PAYE reference number, on the pension regulators website. Click here.

Prompt to complete work period (IRIS Payroll Business / Bureau Payroll users)

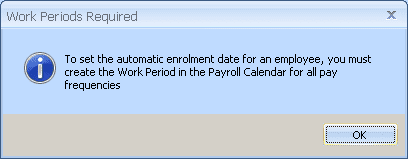

When you click “Next” you may see the following prompt:

If you are seeing this message there is additional information that is required in your company “Payroll Calendar“.

Please read this KB for further details:

https://www.iris.co.uk/support/knowledgebase/kb/11400

The user will be able to proceed with the rest of the configuration tool without entering this additional information. However, it is vital that it is completed in advance of the staging date for assessment/enrolment to occur correctly.

For more details on the individual steps of the configuration tool, please follow the links below:

Step 2 – Nominate a contact with The Pensions Regulator

Step 3 – Contact details of the pension administrator at your company

Step 4 – Pre-staging workforce assessment

Step 5 – Choose your pension provider

Step 6 – Pension Provider scheme details you will use for automatic enrolment

Step 7 – Define the pay elements for Qualifying and Pensionable Earnings

Step 8 – Pension Provider output file details

Step 9 – Configure your Postponement Period

Step 10 – Declaration of Compliance (register) for The Pensions Regulator

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.