AE Config Tool - Step 4 - Pre-staging workforce assessment

Article ID

12048

Article Name

AE Config Tool - Step 4 - Pre-staging workforce assessment

Created Date

1st May 2019

Product

IRIS PAYE-Master, IRIS Payroll Business, IRIS Bureau Payroll, IRIS GP Payroll, IRIS Payroll Professional, Earnie

Problem

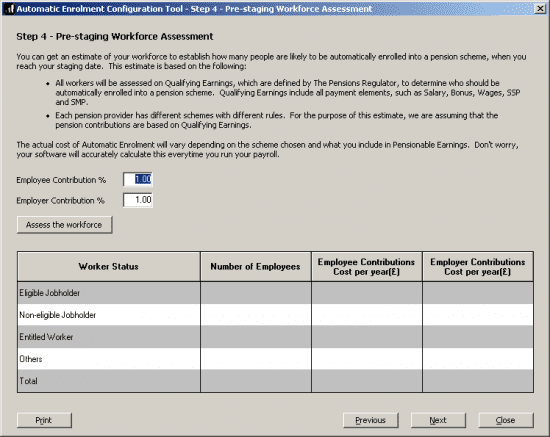

From this screen, you can run a workforce assessment prior to staging. This will give you an ESTIMATE of how many employees are likely to be automatically enrolled into a pension scheme at your staging date.

Before setting up any automatic enrolment details we strongly recommend you make sure your payroll software is up to date with the latest version.

Please visit our downloads page to check for updates to your software

Click here

Resolution

To get an estimate of the effect of AE on your payroll, type in the employees and employers contributions you will use and click “Assess the workforce“. Currently (2016/2017 tax year) the minimum contributions are a total of 2% of qualifying earnings with at least 1% coming from the employer. The contributions can be set higher if you desire.

You can retain a copy of this assessment by click the “Print” button.

Please Note: This assessment is dependent on the presence of payroll history for the employees. If you are setting up AE using the wizard on a new company file (ie. that hasn’t calculated payroll yet) employees will be assessed as ‘Entitled‘. This is also the case for new starters on an existing company file if they haven’t yet had payslips calculated. This will not affect the software assessing and enrolling employees correctly once your staging date has been reached.

You can return to this step and redo the pre-staging assessment as many times as you wish.

There is no legislative requirement for you to complete this step, it is contained in this configuration tool for illustrative purposes only.

For more details on the individual steps of the configuration tool, please follow the links below:

Step 1 – Your company’s staging date

Step 2 – Nominate a contact with The Pensions Regulator

Step 3 – Contact details of the pension administrator at your company

Step 5 – Choose your pension provider

Step 6 – Pension Provider scheme details you will use for automatic enrolment

Step 7 – Define the pay elements for Qualifying and Pensionable Earnings

Step 8 – Pension Provider output file details

Step 9 – Configure your Postponement Period

Step 10 – Declaration of Compliance (register) for The Pensions Regulator

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.