What are the earnings thresholds for Auto Enrolment pensions?

Article ID

11427

Article Name

What are the earnings thresholds for Auto Enrolment pensions?

Created Date

27th February 2019

Problem

What are the earnings thresholds for Auto Enrolment pensions?

Resolution

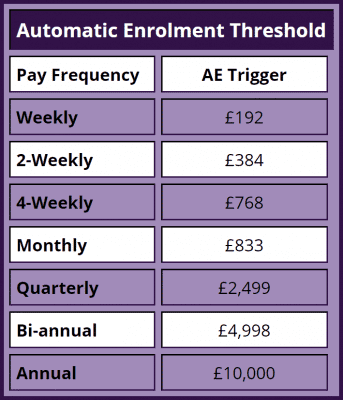

If the employee earns more than the minimum earnings threshold shown below and are not currently in a qualifying pension scheme they will be auto enrolled (tax year 2019/20):

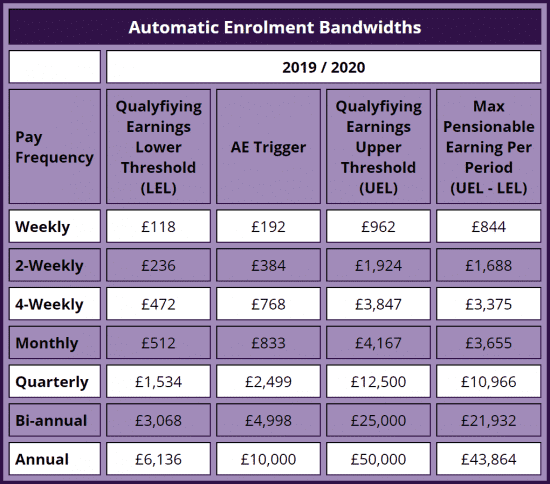

If the employer is using the type ‘Percentage Auto Enrolment’ for pension deductions they will then pay on the banded earnings basis, where contributions are based on the employee’s earnings within the LEL (lower earnings limit) and the UEL (upper earnings limit).

NOTE: As per the 19/20 tax year, the total minimum contribution is 8% with 3% minimum EMPLOYERS contribution. If your pension provider claims tax relief for employees, effectively you deduct 4% and the remaining 1% is claimed by the scheme provider for the total 5% employee contribution.

| Date | Employer minimum contribution | Total Minimum contribution |

| Staging Date – 05/04/18 | 1% | 2% (including 1% staff contribution) |

| 06/04/18 — 05/04/19 | 2% | 5% (including 3% staff contribution) |

| 06/04/19 onwards | 3% | 8% (including 5% staff contribution) |

You and/or your staff can pay more than the minimum, see contributions and funding information from the pension regulator.

For further automatic enrolment queries check our guides and FAQs here.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.